Automate TradingView Stratergy

With this new feature, Take Profit and Stop Loss levels will be automatically set as soon as an entry order is executed, ensuring better risk management and execution efficiency.

Understanding TradingView Strategies Supported by PickMyTrade

PickMyTrade supports the following three strategy types:

| Strategy Type | Description | Automation Supported By PickMyTrade | Supports TP & SL at PickMyTrade? |

|---|---|---|---|

| Continuous Position Strategy | Maintains an open position (long or short) at all times. Exits the current position only when switching to a new one. Ensures constant market exposure with no downtime between trades. | ✅ Yes | ✅ Yes |

| Flat Position Strategy | Opens and fully closes a trade before entering a new one. No overlap of positions. This strategy offers a more cautious approach by ensuring that previous positions are closed before initiating new ones. | ✅ Yes | ✅ Yes |

| Partial Exit Strategy | Uses multiple exit points (e.g., TP1, TP2) to scale out of a position. Instead of closing the entire trade at once, partial profits are taken at different levels. Offers flexibility in volatile markets. | ✅ Yes | ❌ No (Currently Unsupported) |

Understanding the Strategies (Generate Alert TradingView Stratergy / Indicator Click here )

Continuous Position Strategy

- Always keeps a trade open.

- When a new buy alert comes, it closes the sell position and opens a buy position (and vice versa).

- Suitable for strategies requiring continuous market exposure.

Flat Position Strategy

- Ensures all positions are closed before opening a new one.

- Avoids overlapping trades and minimizes risk.

- Ideal for traders who prefer clear trade cycles without carryover risk.

Partial Exit Strategy

- Trades are exited in portions instead of closing the entire position at once.

- Allows flexibility in volatile markets.

- Currently, this strategy does not support take profit (TP) or stop loss (SL) management.

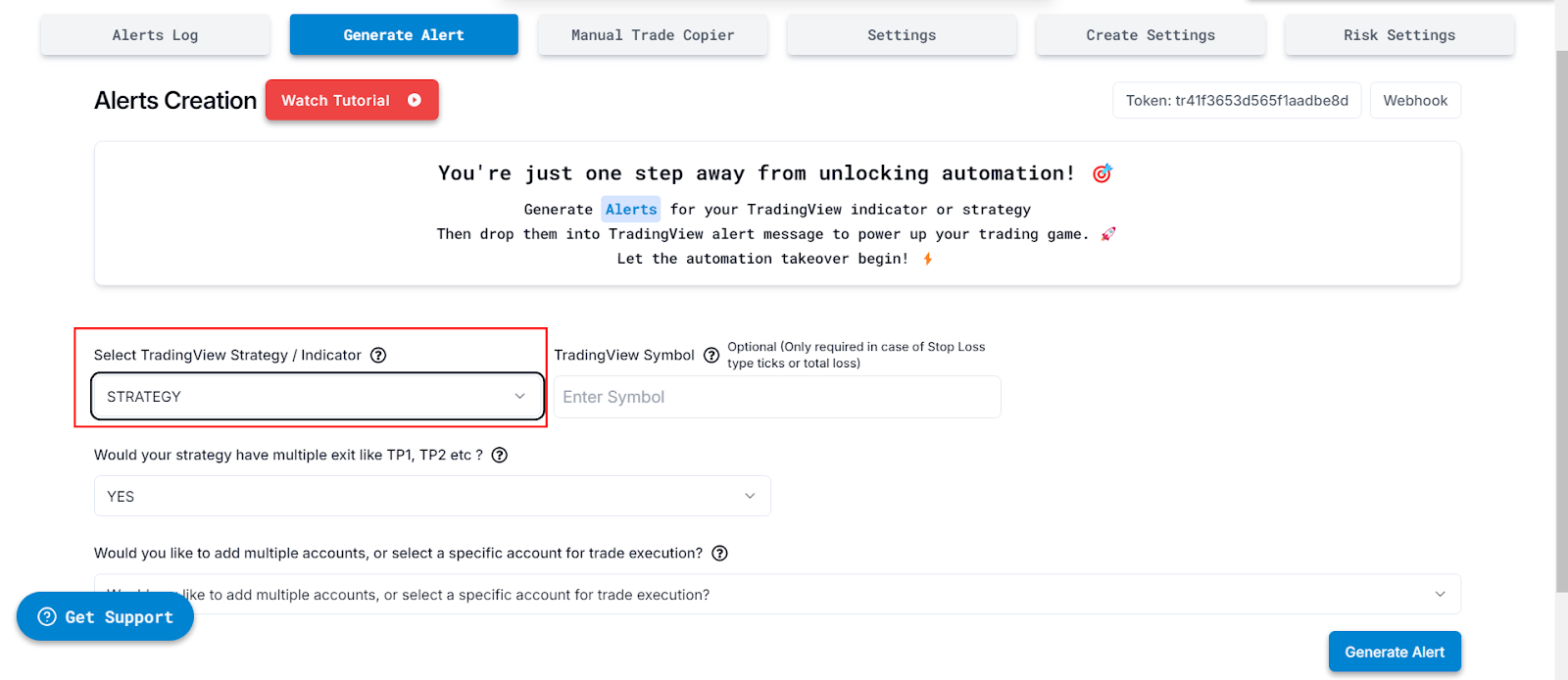

Strategy-Based Trading Setup

(For traders using a TradingView strategy that generates buy/sell signals automatically.)

1️⃣ Select Your Strategy: Choose a TradingView strategy to automate.

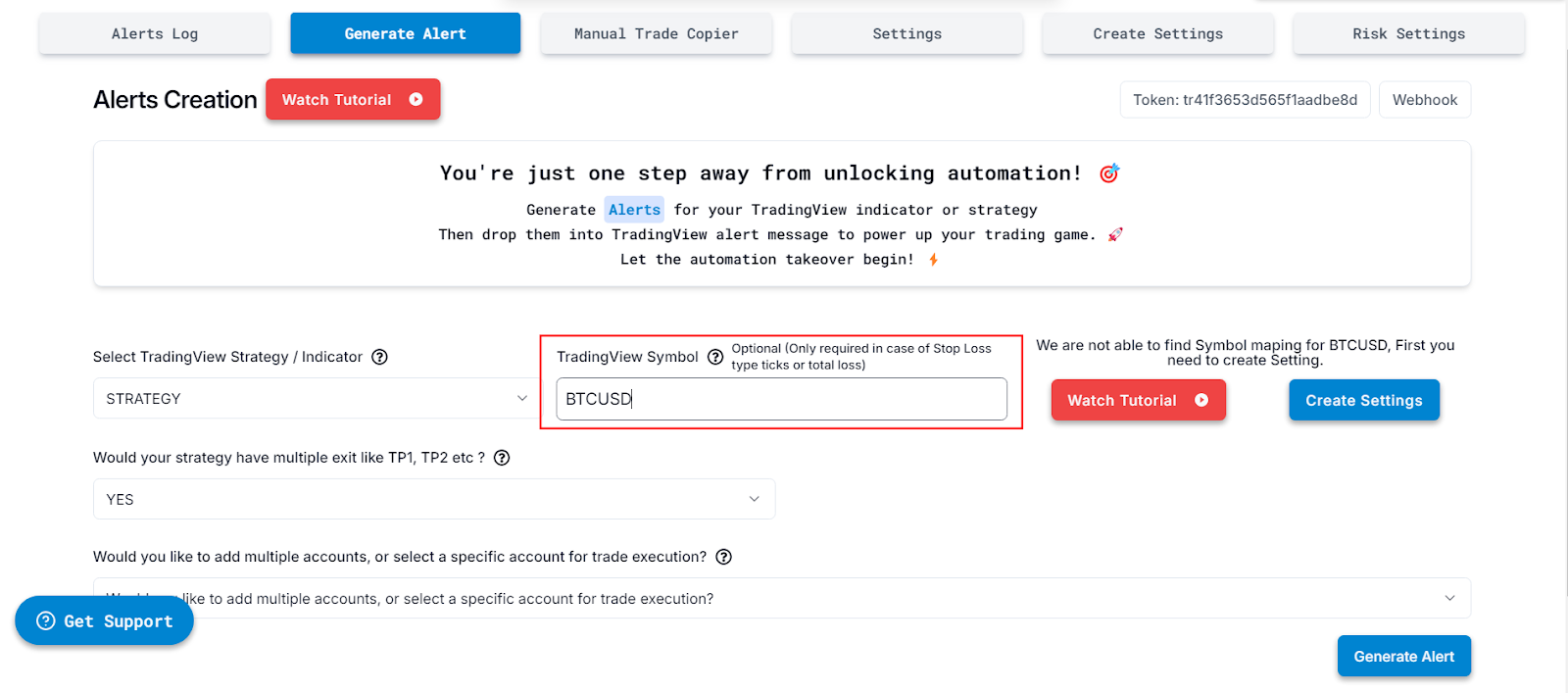

2️⃣ Enter Trading Symbol: Specify the trading asset (e.g. MNQ, NQ). (Required for stop-loss calculations using ticks or total loss methods.)

- If the symbol doesn’t exist or isn’t mapping correctly: You’ll need to set it up first in PickMyTrade. Only after that will trades happen on that symbol.

- Want to send an alert from one symbol and trade another? You can! For example:

- You’re using NQ on your TradingView chart for the alert.

- But you want the actual trade to happen on MNQ.

- In this case, just enter MNQ in the PickMyTrade symbol field. - What if you don’t enter a symbol here? No worries — PickMyTrade will simply take the trade based on whatever chart you’ve set up in TradingView for the alert.

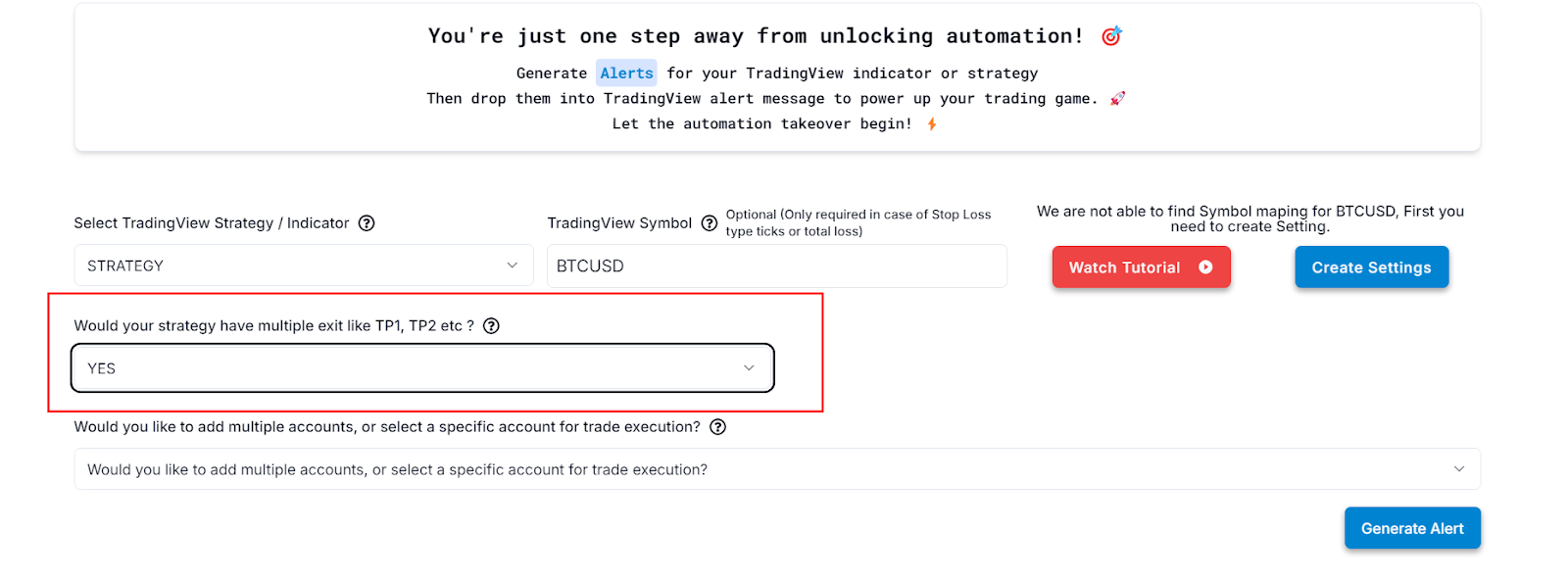

3️⃣ Confirm Exit Handling:

Multiple Exits (TP1, TP2)?

YES: If your strategy already manages multiple exits (e.g., TP1, TP2), PickMyTrade will not request additional Stop Loss (SL) or Take Profit (TP) settings. However, please note:

- Automated Exits: You can automate your exits directly through your strategy.

- Attaching SL/TP to Entry Orders: If you choose to attach Stop Loss and Take Profit directly to your entry orders in PickMyTrade, you will be limited to only one Take Profit (TP) and one Stop Loss (SL) per order — multiple exit levels (like TP1, TP2) won’t be supported in this case.

NO: If your strategy does not manage exits, you’ll need to manually configure the Stop Loss (SL) and Take Profit (TP) settings in PickMyTrade.

Would your strategy have multiple exits like TP1, TP2, etc.?

NO

- → Would you like to place Stop Loss and Take Profit orders in PickMyTrade with each order from your

strategy?

- YES

-→ Stop Loss / Take Profit / BreakEven Type: (Please refer to the table provided earlier in the "Select TradingView Indicator" section for detailed explanations on each option Click here )